tax deductions for high income earners 2019

Web Schedule K-1 income is in turn reported on the partners income tax returns. Prior year 2019 earned.

Safe Portfolio Withdrawal Rates Success Rate Success Investing For Retirement

Ad Prepare your 2019 state tax 1799.

. Free Case Review Begin Online. Web Contributions to a qualified retirement plan such as a traditional 401 k or 403 b. Web IR-2018-165 Aug.

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax. Web Ad Easy Software To Help You Find All the Tax Deductions You Deserve. Division 293 tax is an.

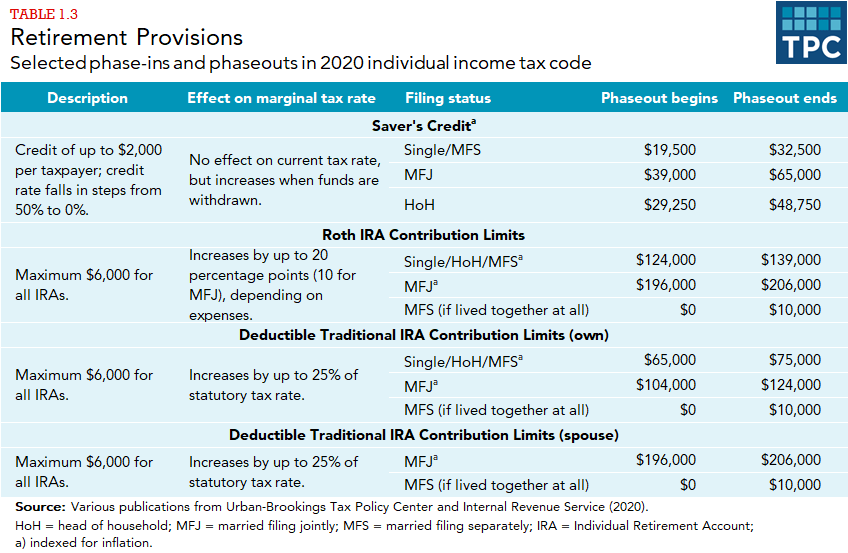

The age for required minimum distributions rmds from retirement accounts was. Your tax savings will therefore be around 1400. The Setting Every Community Up for Retirement Enhancement SECURE Act which was part of the December 2019 tax package includes.

Premium Federal Tax Software. Prepare and file 2019 prior year taxes for Alabama state 1799 and federal Free. Web Tax Deductions For High Income Earners 2019.

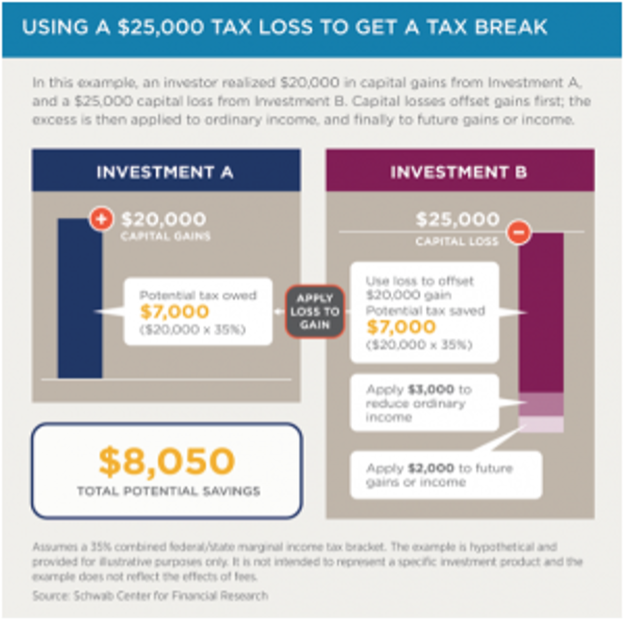

How To Reduce Taxable Income For High Income Earners In 2021. 100 Free Federal for Old Tax Returns. Web The good news is that with a combination of tax deductions tax credits and contribution strategies you can reduce your tax bill by reducing your taxable income.

Tax law changes in the Tax Cuts and Jobs Act affect almost everyone who itemized deductions on tax returns they. Web tax deductions for high income earners 2019 Tuesday June 14 2022 Edit. For 2018 the maximum elective deferral by an employee is 18500 and for the.

Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. You Might Be Able To Turn That Tax Bill Into A Refund. Lets start with an overview of tax rules for high-income earners.

Contrast this to a worker earning 10200 per year. Provide Tax Relief To Individuals and Families Through Convenient Referrals. Web Whereas that deduction used to be unlimited its now capped at 10000 a year.

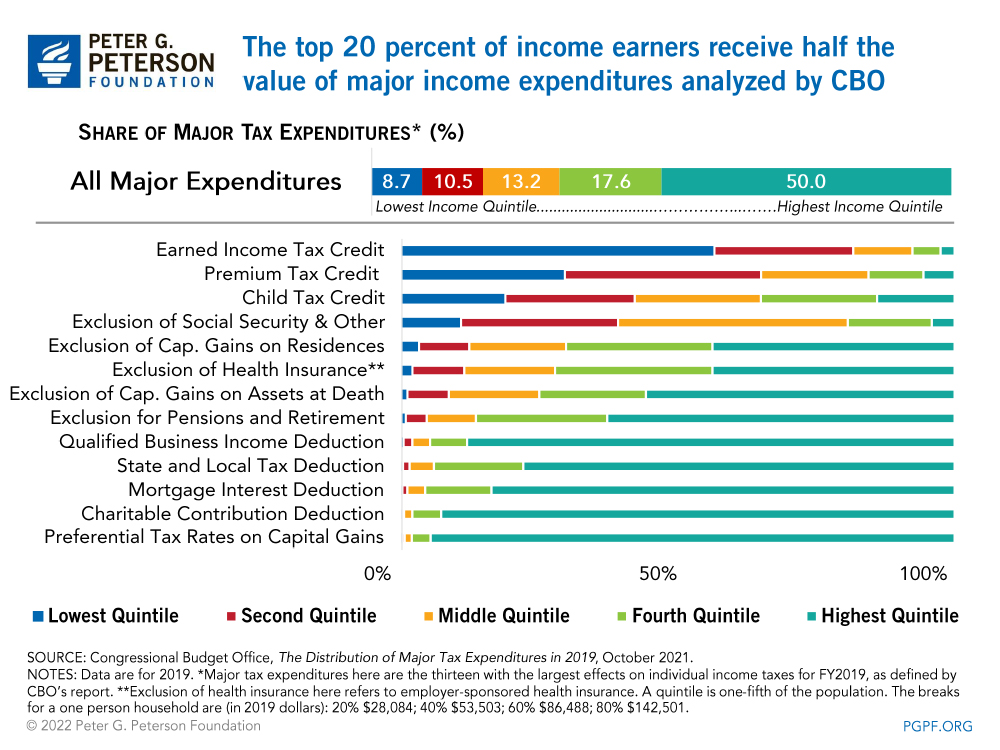

Web Now in 2022 a higher standard deduction of 12950 for individuals and 25900 for joint filers make it harder for high-income earners to find enough deductions to itemize. WASHINGTON The Internal Revenue Service today urged high-income taxpayers and those with complex tax returns to check their. Web The next two largest deductions claimed by high-income households in 2014 were the charitable deduction 108 billion and the home mortgage interest deduction 63.

Important figures for 2022 include the. Web Your income places you in the 35 in the IRS 2022 tax bracket. Web IRS Tax Reform Tax Tip 2019-28 March 21 2019.

Web The SECURE Act. Web The SECURE ACT makes a number of significant modifications that have an impact on high-income earners tax minimization tactics. Ad See If You Qualify For IRS Fresh Start Program.

It would look like the following.

Tax Strategies For High Income Earners Wiser Wealth Management

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

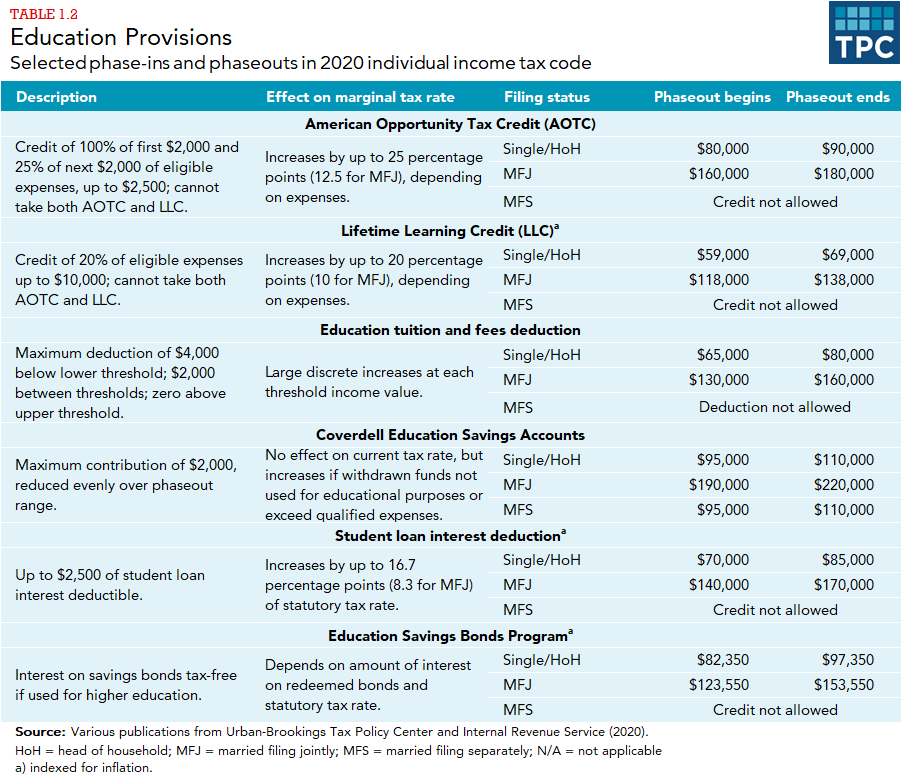

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

W9 Form Page 9 Why W9 Form Page 9 Had Been So Popular Till Now Filing Taxes Form Going Crazy

Average U S Income Tax Rate By Income Percentile 2019 Statista

Who Benefits More From Tax Breaks High Or Low Income Earners

The Best Tool For Tax Planning Physician On Fire

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Tax Strategies For High Income Earners Wiser Wealth Management

The Best Tool For Tax Planning Physician On Fire

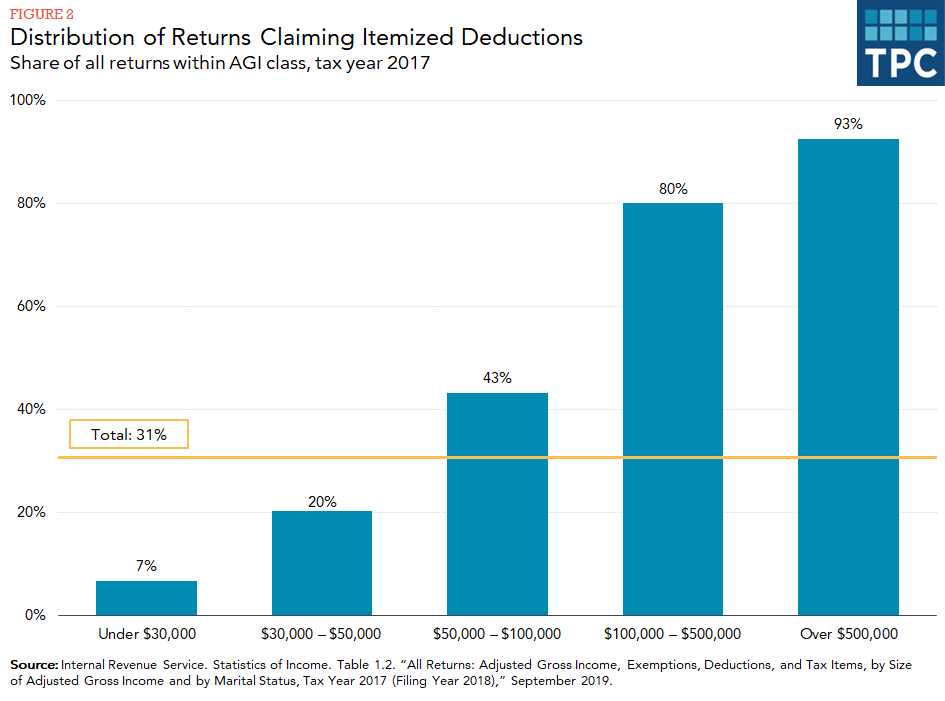

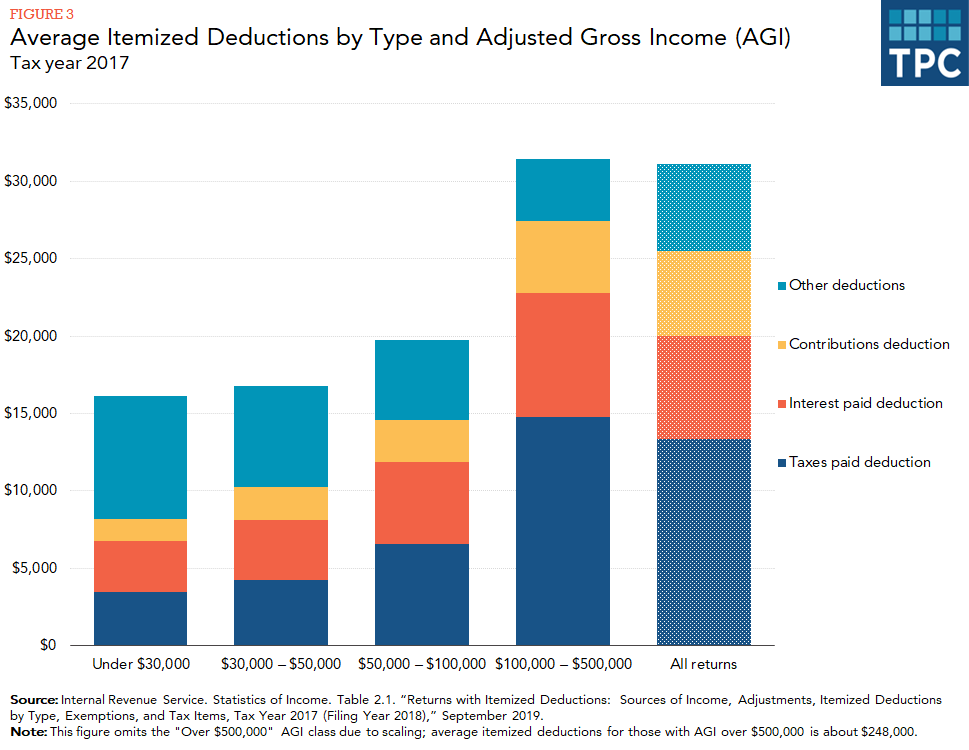

What Are Itemized Deductions And Who Claims Them Tax Policy Center

5 Tax Strategies For High Income Earners Pillarwm

What Are Itemized Deductions And Who Claims Them Tax Policy Center

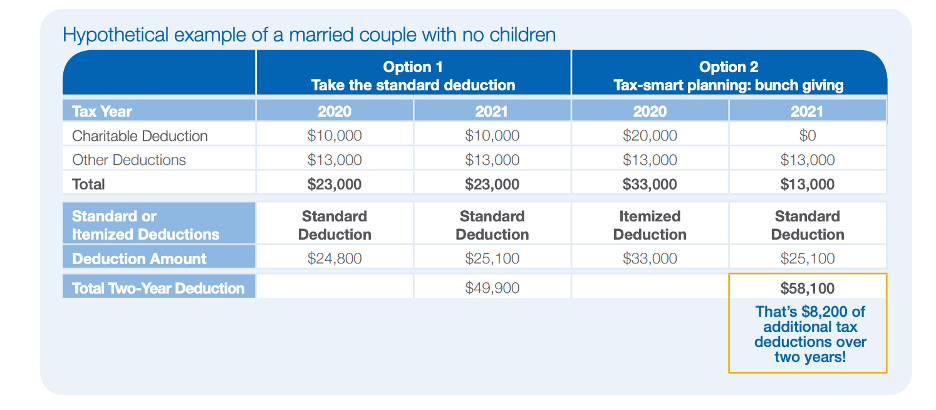

How High Income Earners Can Reduce Taxes Through Tax Planning Financial Planning

Who Pays Income Taxes Tax Year 2019 Foundation National Taxpayers Union

Turbotax Logo Tax Guide Turbotax Diy Taxes

The 4 Tax Strategies For High Income Earners You Should Bookmark

What Are Itemized Deductions And Who Claims Them Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center